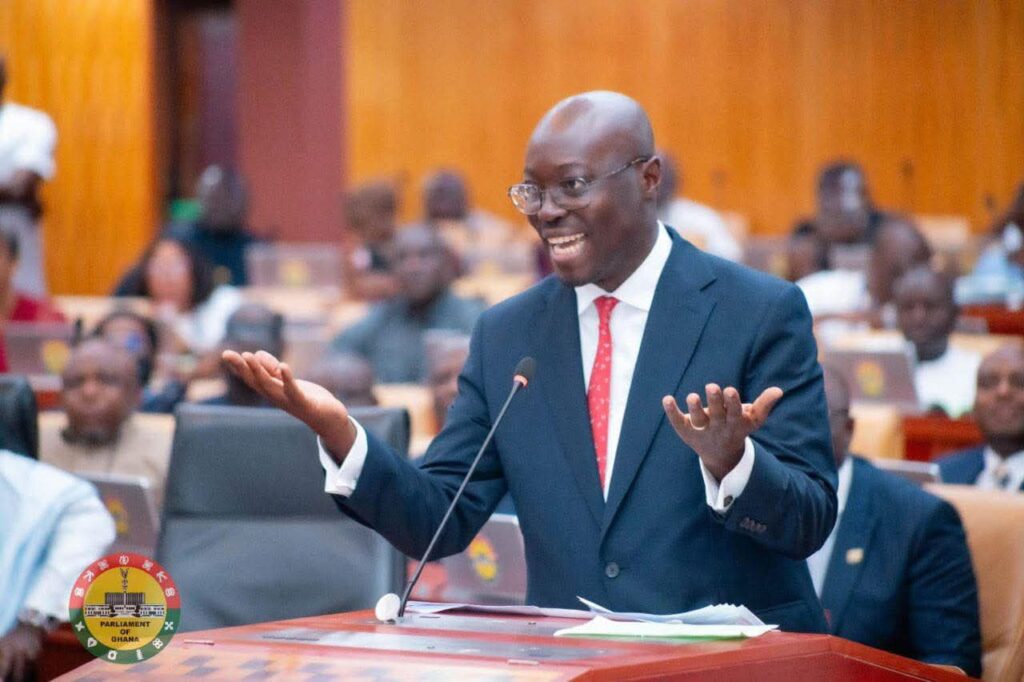

Finance minister Hon Ato Forson Announced New VAT reforms start today

Altogether, these VAT reforms are expected to return nearly GH¢6 billion to businesses and households this year alone!, the COVID-19 levy has been abolished, putting Ghc,3.7 billion back into the pocket of individuals and business’s in 2026 alone,

The VAT rate has been reduce to 20 percent to ease the tax burden on households and business, GETfund and NHIL,levies are now input output deductible, reducing the cost of doing business by about 5 percent, Business dealing in goods will now register for VAT only when turnover exceeds GHC750,000- up from GHC200,000.

The VAT flat rate scheme has been abolished and replaced with a unified and more transparent VAT structure

This is tax relief in action resetting for growth, jobs and economic transformation

story by Amaglo Ransford Edem